The iPhone 13’s level of depreciation is half that of the iPhone 12.

– After month 1 and 2, the iPhone 13 has lost up to 50% less value than the iPhone 12.

– The iPhone 13 sees the lowest depreciation two months post launch than other iPhone generations, depreciating by only 25.5%.

– iPhones, over a 12-month period, hold their value more than any other brand, but this is exceptionally low depreciation… even for an iPhone.

– iPhone 13 buyers may well be sitting on the best iPhone investment yet.

The dust has now settled on what was an exceptionally successful iPhone 13 launch back in September. Apple released details of the new 13 range of smartphones to quite the fanfare, and this saw fans of the ecosystem clamoring to get a piece of the pie.

As expected, the iPhone 13 (all variants) faced shortages within minutes, leaving some consumers empty-handed. While this is always going to be a disappointment for customers, further bad news came as shipping delays hit the iPhone 13, thanks to the electronic component shortage blighting the tech industry as a whole. However, doesn’t every cloud have a silver lining, to coin a phrase? Yes, it does…

These delays are, of course, inconvenient. However, the knock-on effect of such setbacks is inevitably an increase in demand for the product in question. This means that the iPhone 13 has seen the best value retention over the first two months since launch, compared to previous models; not just great news for Apple, but great news for those who secured a handset at launch.

SellCell has compared trade-in values for the iPhone 13-series handsets with those of the iPhone 12 and iPhone 11, with some promising results. Let’s analyze why these setbacks may well be a blessing in disguise for both Apple and iPhone 13 owners alike.

Main Highlights

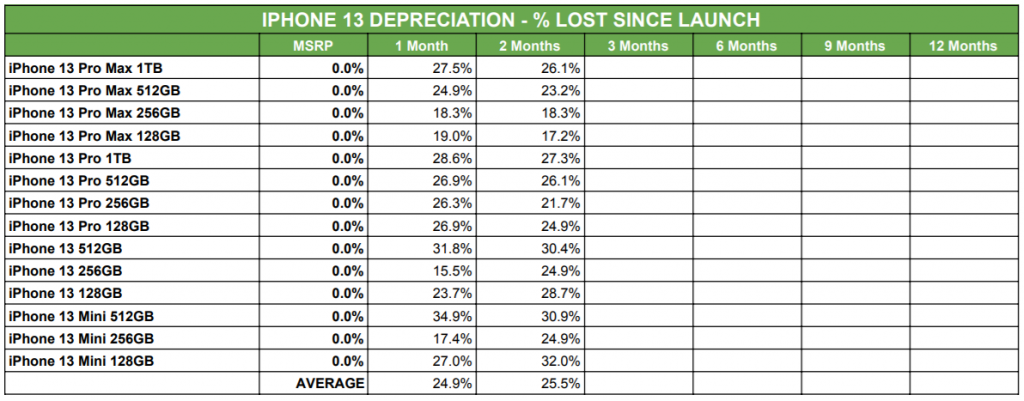

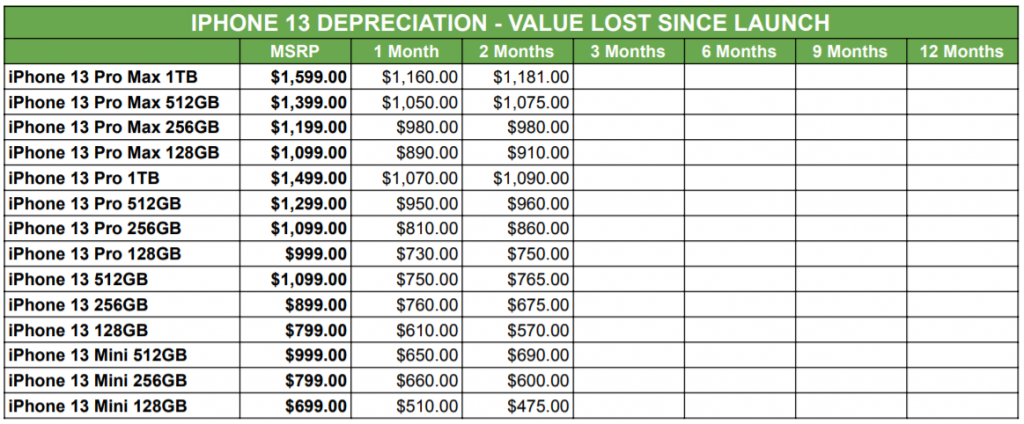

- The iPhone 13-series has only seen depreciation of 25.5% of MSRP across the entire range in months one and two; an unprecedentedly low depreciation figure and the lowest yet for any iPhone launch.

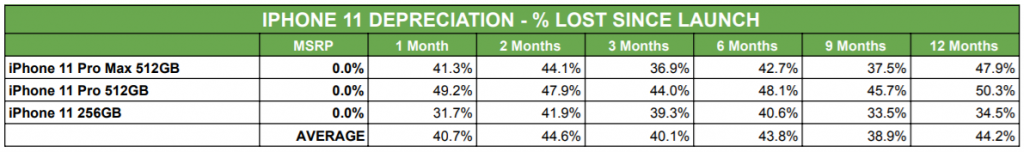

- iPhone 13 depreciation is 19.1% less than the iPhone 11-series depreciation in months one and two.

- iPhone 13 depreciation is 15.5% lower than that of the iPhone 12 in the same period post launch.

- On average, the iPhone 13 entire range has depreciated by only 0.6% between months one and two, with a depreciation of 24.9% by the end of month one, and depreciation of only 25.5% by the end of month two.

- The iPhone 13-series hasn’t just retained a lot of its value; between months one and two, some models have seen value recovery after an initial drop post-launch.

- The premium models have held or regained value, with the iPhone 13 Pro Max 1 TB regaining 1.4%, the 512 GB variant recovering 1.7% of its launch price, and the 128 GB version seeing an impressive 1.8% regain. The 256 GB model remained unchanged, losing 18.3% of its value in month one and holding value in month 2.

- The Pro models have performed well, with the 128 GB model regaining 2% of its initial value in month two. The 256 GB iPhone 13 Pro saw the best value recovery, reclaiming a huge 4.6% of its initial value.

- The “budget” iPhone 13—the Mini range—lost average value across the three handsets. Only the 512 GB model regained, claiming back 4% of its value. The 256 GB and 128 GB models lost 7.5% and 5% respectively.

Findings

SellCell has analyzed buyback prices from over 45 sources, delivering an accurate picture of how the iPhone 13 has depreciated in the past two months. It then compared this to the iPhone 11 and 12 post their respective launches, to see if any patterns emerge.

iPhone 13-Series Depreciation

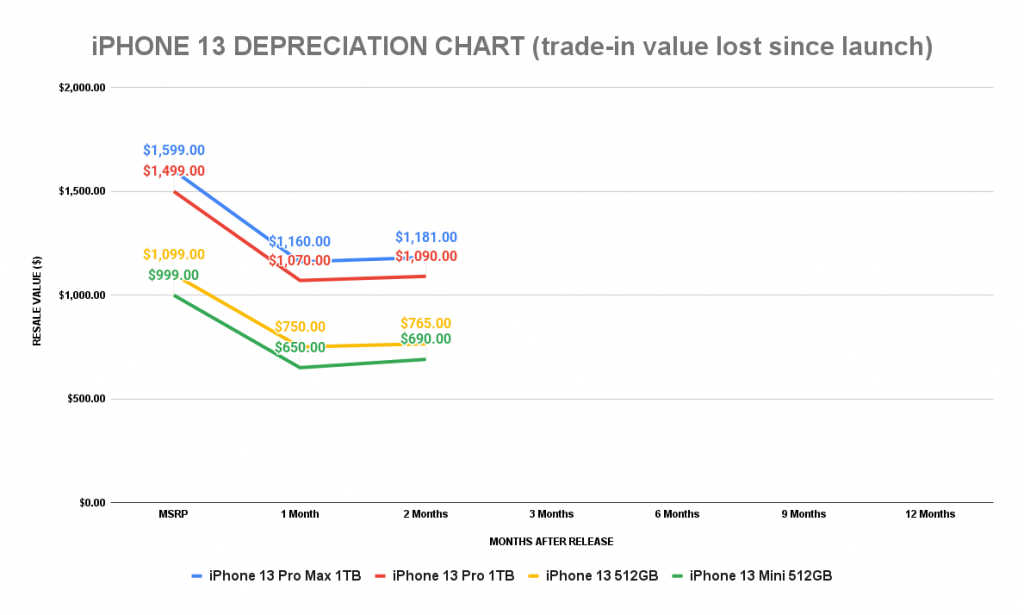

It is plain from the figures above that the iPhone 13-series has performed well in the two months since launch. The rate of depreciation has been incredibly slow, with the iPhone 13-series only losing 24.9% of its value in month one, the slowest depreciation of any iPhone range in a long time.

Moving to month two, we can see that depreciation has slowed tremendously; the iPhone 13 has lost only a further 0.6% of its value between months one and two, sitting at an average 25.5% depreciation since launch. This level of depreciation is unheard of; historically, iPhones have lost significantly more value during this time.

As depicted, more handsets from Apple’s new range of smartphones have actually recovered value during month two, which has led to this low average depreciation. This is despite all iPhone 13 models losing value initially. One should expect such a phenomenon, though. All smartphones lose value immediately after launch.

So, which iPhone handsets performed best within that two-month, post-launch period? Perhaps surprisingly, the iPhone 13 Mini 512 GB saw the most value recuperation since September. Having lost $349 in the first month, the mighty Mini clawed back an awe-inspiring $40; something almost unheard of in the smartphone industry.

The iPhone 13 Pro Max 1TB—the most expensive handset in the new range—came second. Although it lost $439 in value during the first month post-launch, it regained $21 during month two, rather than see a further drop in value. The 13 Pro 1 TB model recovered $20, and the iPhone 13 512 GB pulled back $15 of its original MSRP.

What has caused this value recovery, though? And what is preventing these handsets from depreciating further?

Why Have Some iPhone 13 Models Held Their Value So Well Compared to Previous Generations?

As mentioned, Apple has delayed delivery of the new 13-series smartphones. It has also cut production by 20%. This means that these particular handsets will be scarce once Apple fulfills pre-orders.

Therefore, it wouldn’t be unreasonable to believe that—until Apple start’s to meet the unprecedented demand with a supply of iPhone 13s stocking the shelves—we may see models recovering even more value as 2021 closes out.

It isn’t all good news, though. Across the board, the combined average loss between all handsets is 25.5%, and increase on the average of 24.9% we saw across the full range in month one. So, iPhone 13s have lost value overall, just not as drastically as you would expect. And, in specific cases, even recuperating some of the initial loss.

How Does This Compare to the iPhone 11 and 12?

If we look at historical figures for the iPhone 11 and iPhone 12 in the same period after their respective launches, we might see a pattern emerging, although less so with the iPhone 11-Series. The crux here, however, is the depreciation rate itself.

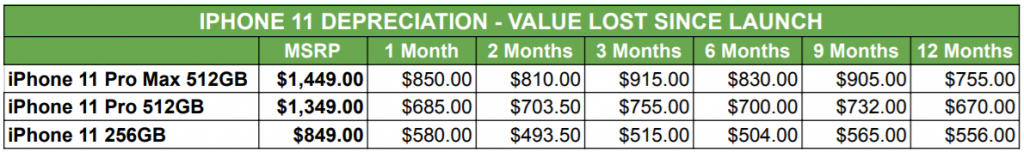

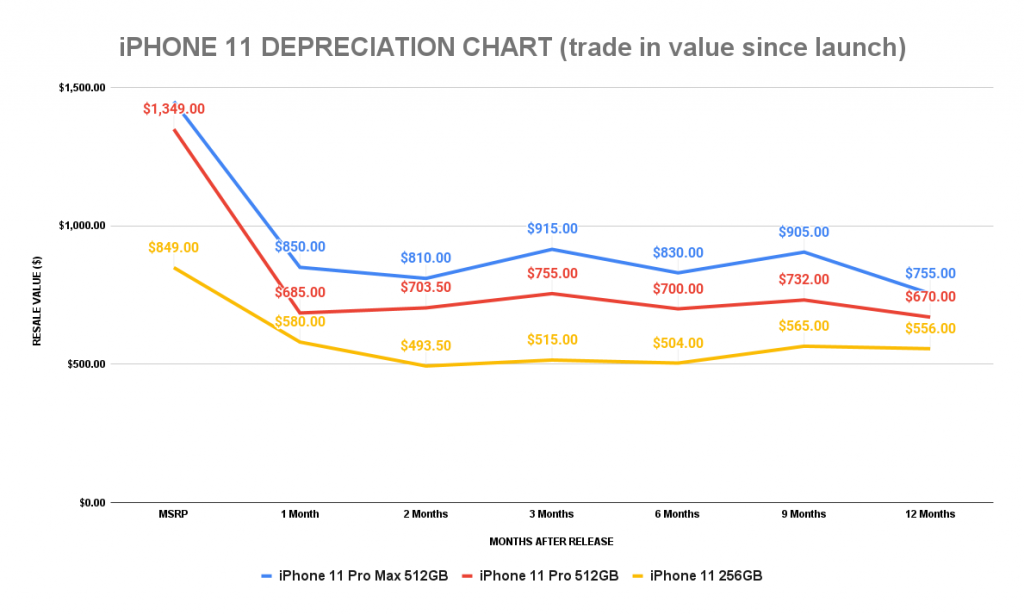

As you can see from the table above, the iPhone 11 series suffered a depreciation of 40.7% in month one after launch, which then rose to 44.6% by the end of month two; an increase of 3.9%. All of these figures are drastically different from those displayed by the iPhone 13-series.

Looking at the table above, we can see the iPhone 11 Pro Max 512 GB and iPhone 11 512 GB handsets both behaved similarly to the iPhone 13’s best-performing models. Despite a reduction in value in month one, both handsets bounced back, regaining $40 and $18.50 respectively.

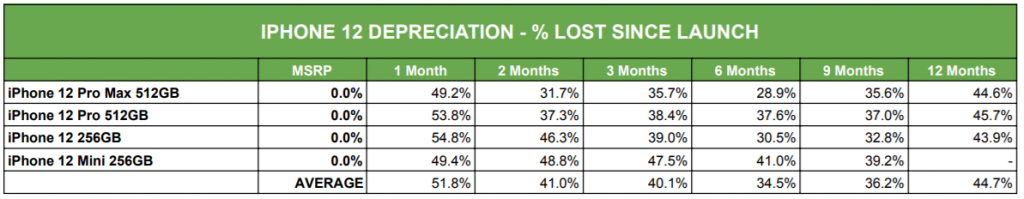

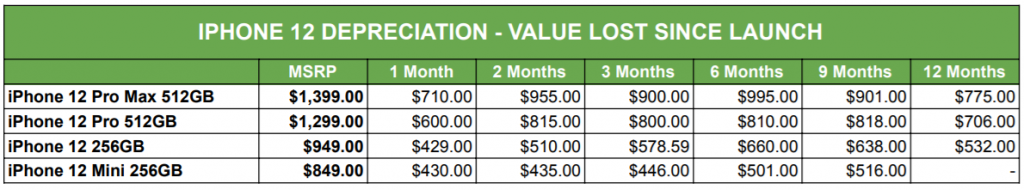

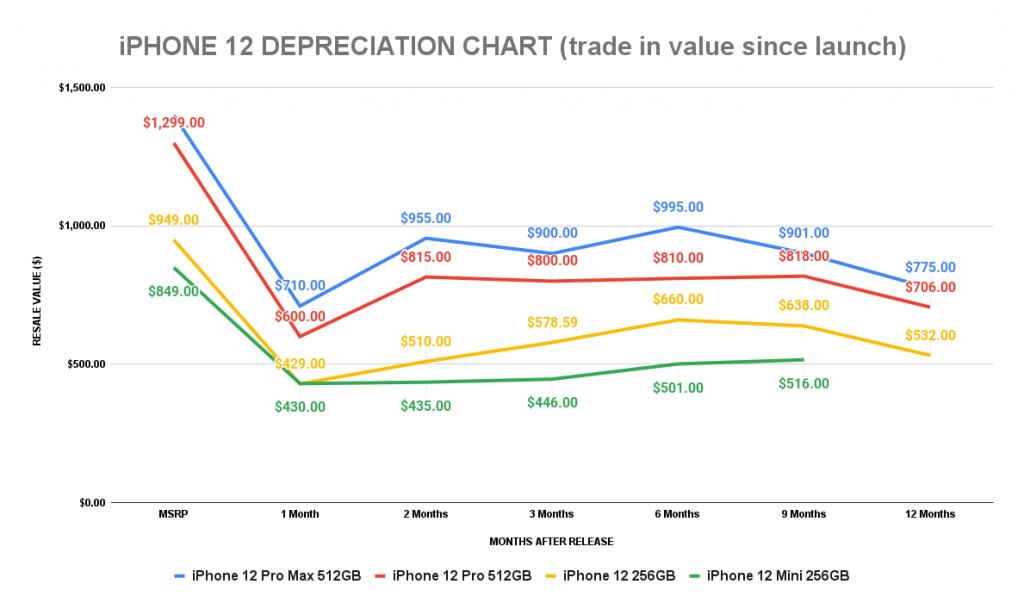

The iPhone 12 performed even worse during month one, when compared to the iPhone 13. Month one depreciation reached a massive average of 51.8% in the first month, which is over half the value of the handset. While that figure recovered during month two, depreciation still sat at 41.0%.

Comparing this to the iPhone 13, and we have differences in month one and two of 26.9% and 15.5% respectively. The iPhone 13 saw depreciation of over 50% less than the iPhone 12 range did within the same period.

Again, we can see how these handsets dropped in value at first, and then recaptured some of that loss. In some cases, such as with the iPhone 12 Pro Max 512 GB, by up to $245, which is almost difficult to believe going off depreciation trends with smartphones from different brands.

What Do These Figures Tell Us?

What these figures potentially tell us, is that a component shortage and a global health crisis are always going to have a knock-on effect on the value of a smartphone. Why? Because scarcity leads to higher demand. With this demand, trade-in prices (and therefore the value of the handset) can comfortably stay high. People want the new iPhone and, with iPhone production down 20%, SellCell doesn’t see this demand wavering… yet.

This is likely to be the case across the entire tech industry and is simply down to supply vs. demand. It isn’t necessarily that more consumers want to enter the iPhone ecosystem; it is simply that there are less handsets available to service those customers. As a result, even two months after the launch of the iPhone 13, people are still waiting to get one. This means demand stays high, and so does the value of the iPhone 13 as a result.

Could this slow depreciation trend continue for future iPhone releases? Well, possibly not. Unless the component crisis continues into 2022/2023, it is more than likely that Apple will have enough handsets to ensure supply meets demand, once the iPhone 14 comes around. With this in mind, it is unlikely we’ll see this slow rate of depreciation again. We can’t say that for sure, but the chip shortage and global health crisis are unique circumstances that (we all hope) we will never see again.

iPhones hold their value better than any other brand over a twelve-month period. So, this also tells us that if you’re in the market for a new phone and can’t decide between the new iPhone or Samsung’s latest flagship offering, your money is probably better spent with Apple, especially if you plan to trade in at a later date.

iPhones generally lose up to half their value within a month (sometimes a lot less depreciation occurs), but recoup some of that loss in month two. Again, this tells us that the iPhone is a prominent investment and, even if you don’t like your new iPhone, keeping hold of it for an extra month will usually see you recover some of that lost value if you decide you need to trade it in.

Summary

In summary, we can say that this is the slowest depreciation of any iPhone in a long time. These figures, however, probably don’t signal a trend. The component crisis and global pandemic have created unique circumstances that we’re unlikely to see again.

As a result, we can feasibly associate this slow depreciation with the demand caused by the above two factors. Both mean a shortage of iPhone 13s hitting the shelves, and so this will increase demand. Hopefully, the component crisis will see resolution by the time the iPhone 14 comes around next year. As a result, SellCell predicts that depreciation will return to normal by next year.

As the data above shows, buying an iPhone is always going to be a better investment than buying another smartphone. That value recuperation rarely happens with any other brand. So, choose wisely when you pick your next smartphone. If you are going to trade in sooner rather than later, then the iPhone will protect your investment better than any other manufacturer’s offerings.

SellCell has taken the above data from its pool of over 45 trusted buyback vendors. In accessing so many trade-in prices, it can paint an accurate picture of which smartphone performs best in depreciation. If you’re looking to trade in your iPhone, or any other smartphone for that matter, it is always best to use a comparison service like SellCell to ensure you’re getting the best return on your initial investment.

Methodology

SellCell analyzed data from its registered buyback vendors, ascertaining trade-in values of the iPhone 13 models. It analyzed data in the two months since launch. SellCell used this data to calculate the depreciation of the iPhone 13 over two months since launch. It then compared this data to iPhone 11 and 12 depreciation data over the same range. SellCell then identified trends in depreciation data for all three iPhone series.