Last updated September 8, 2025

With iPhone 17 set to launch on September 9, Pro/Pro Max lead demand, Air divides opinion, and foldables loom as Apple’s biggest rival risk.

Key findings at a glance

- 68.3 percent of iPhone owners plan to upgrade to iPhone 17 at launch

- Pro/Pro Max account for 38.1 percent of planned upgraders; 16.7 percent will choose the standard model; 13.5 percent the ultra-thin Air

- 72.9 percent of iPhone owners say they are more satisfied today than in past years, but over a quarter (27.1) percent feel Apple has “lost its edge” versus rivals

- High Price is the top barrier (68.9 percent).

- If Apple waits until 2026, 20.1 percent would consider switching to Samsung foldables and 10.2 percent would look at Google – 30.3% of iPhone users- ouch!

- Almost half of iPhone users (49 percent) say nothing about Android appeals to them — yet the majority admit Android is becoming more attractive.

Introduction

Apple’s September keynote, officially branded Apple Event: Awe Dropping, takes place on September 9 and will see the company unveil the iPhone 17 lineup. Ahead of the event, SellCell surveyed more than 2,000 U.S. iPhone owners to measure upgrade intent. The headline figure is clear: 68.3 percent say they plan to upgrade.

That number is up from 61.9 percent for iPhone 16 in 2024 (SellCell iPhone 16 pre-launch survey), showing a meaningful rise in buyer intent year-on-year.

This year’s survey digs into what is driving upgrades, what barriers remain including the propensity to switch to a competitor and how external factors such as tariffs and foldables could shape Apple’s most important launch of the year.

Detailed Highlights

- Nearly seven in ten iPhone owners (68.3 percent) say they will upgrade to iPhone 17, up from 61.9 percent for iPhone 16.

- The Pro/Pro Max remain the most popular choice, accounting for 38.1 percent of intended upgrades, while the new ultra-thin Air appeals to 13.5 percent.

- Satisfaction levels are high: 72.9 percent of users say they are more satisfied with their iPhone than in previous years. BUT at the same time, 27.1 percent feel Apple has “lost its edge” compared to rivals. This is over a quarter of existing iPhone users and remains a big threat to Apple.

- Price remains the biggest barrier on upgrades (68.9 percent), followed closely by users being satisfied with current devices (71.7 percent).

- Foldables are a rising factor: 3.3 percent are holding out for a foldable iPhone, while 20.1 percent say they would consider Samsung and 10.2 percent Google if Apple waits until 2026 to launch a foldable phone..

- Battery life is the top driver for upgrades (53.2 percent), way ahead of AI features at only 7.1 percent as an upgrade reason.

- eSIM adoption is now mainstream, with 72.5 percent saying they like it — though more than a quarter still prefer a physical SIM.

- Tariffs could become a major curve ball: 36.8 percent would hold off on buying if prices rise, and 29.2 percent say it would depend on the increase.

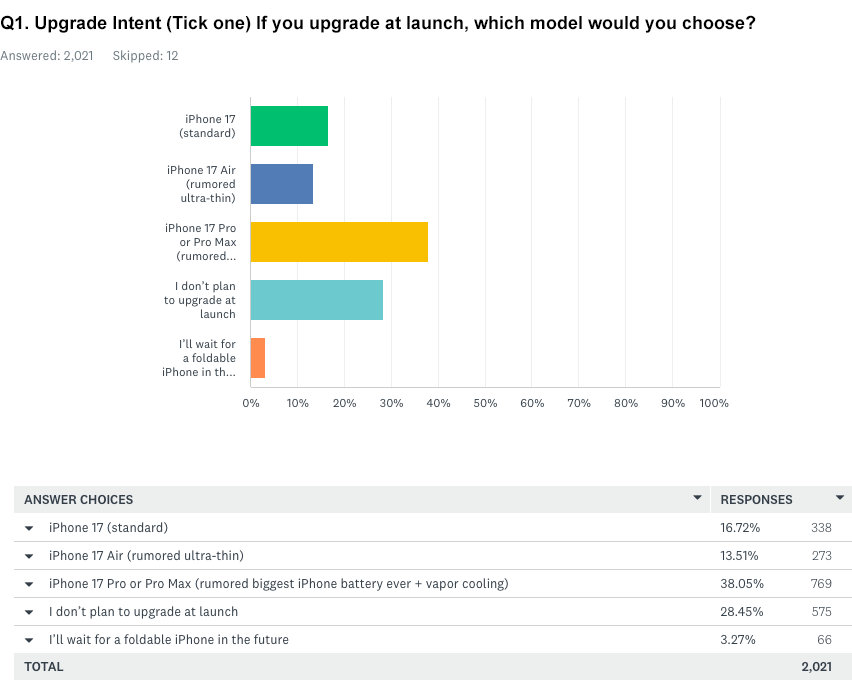

Q1. Upgrade intent

68.3 percent of iPhone owners say they will upgrade to iPhone 17 at launch. Within that, 38.1 percent will choose a Pro or Pro Max, 16.7 percent the standard model, and 13.5 percent the ultra-thin Air. Around 28.5 percent won’t upgrade immediately, and 3.3 percent are waiting for a foldable iPhone.

- Nearly seven in ten plan to upgrade, up on iPhone 16.

- Pro/Pro Max dominate demand, while the new Air accounts for a notable 13.5 percent.

- A small but visible segment is holding out for foldables and remember some of the ones that are currently not upgrading may opt for these too.

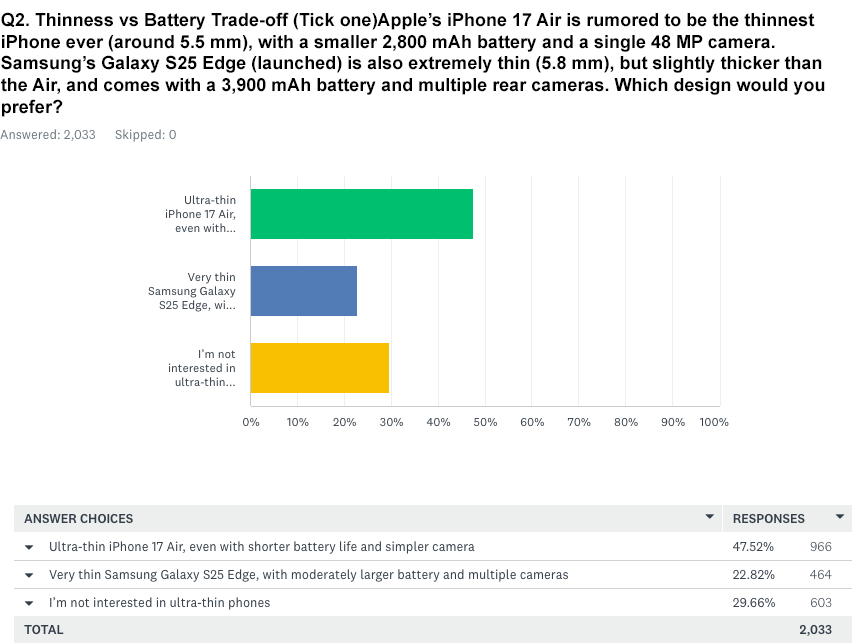

Q2. Thinness versus battery

The thinner the better seems to be the route forward here with apple fanboys. If going down the thinner phone route 47.5 percent would accept less battery life for a thinner device, 22.8 percent prefer Samsung’s Galaxy S25 Edge approach, and 29.7 percent aren’t interested in ultra-thin designs.

- If having to choose a thinner phone option, almost half would prefer to have a thinner phone, even at the cost of battery.

- Samsung’s design direction resonates with one in five.

- A third reject thinness as a priority, underlining the importance of battery.

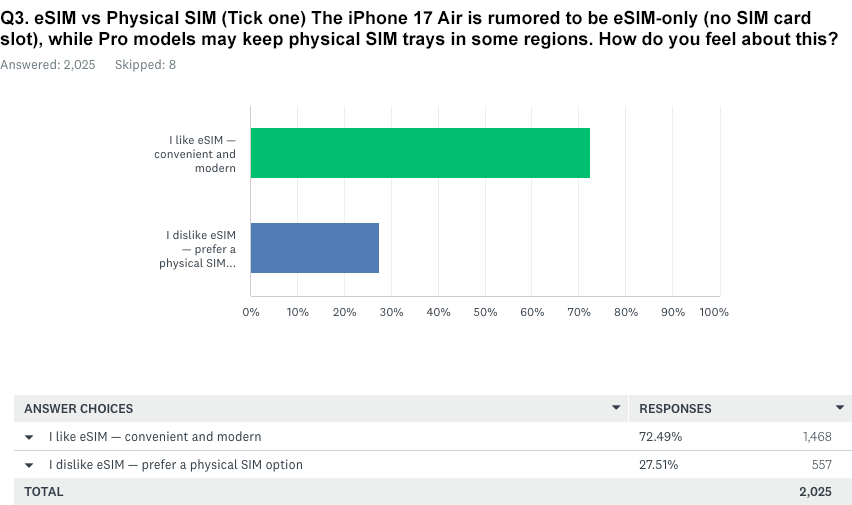

Q3. eSIM versus physical SIM

72.5 percent say they like eSIM, while 27.5 percent still prefer a physical SIM.

- eSIM now has majority support among iPhone users.

- More than a quarter still want a SIM tray, echoing debates since iPhone 14.

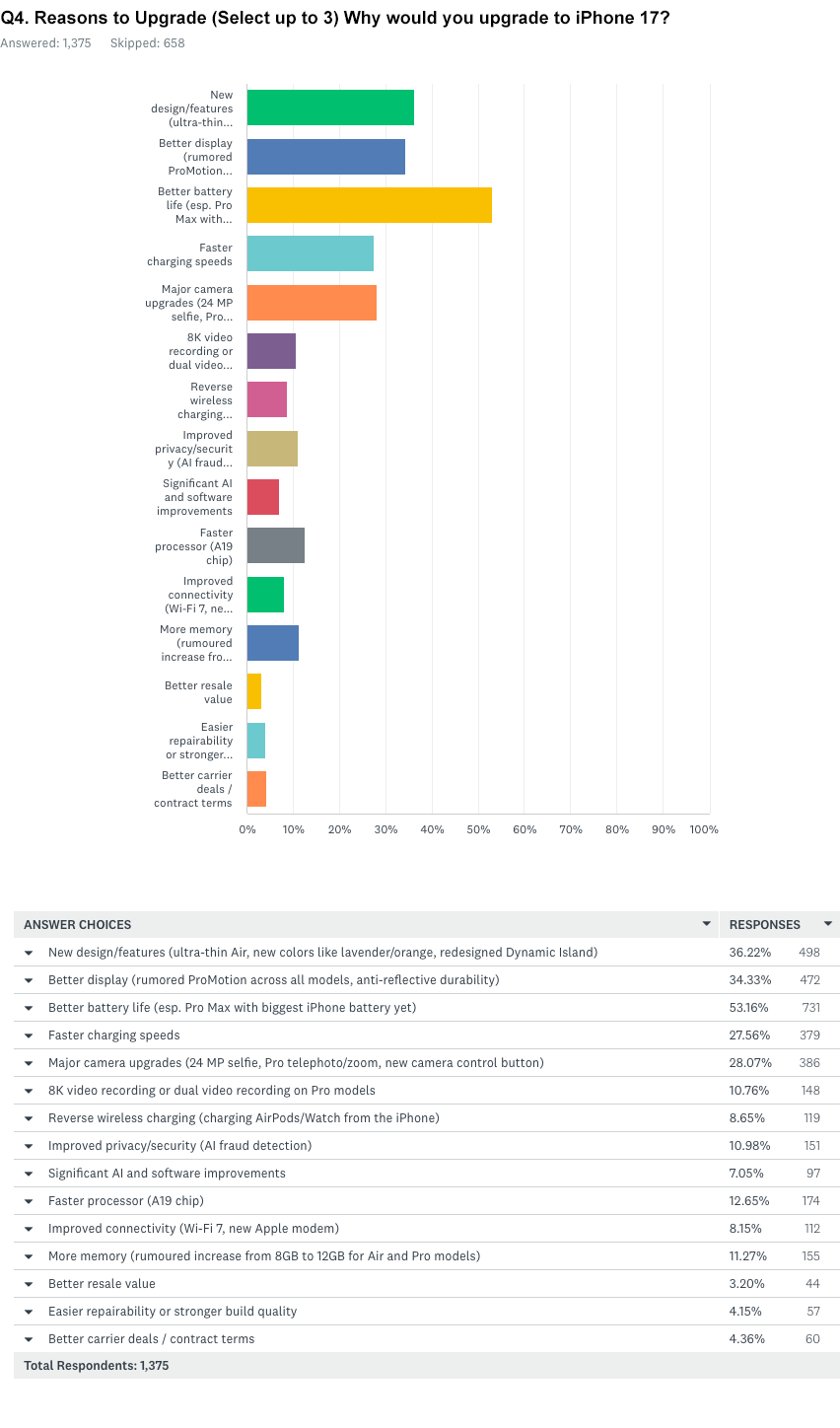

Q4. Why do people upgrade?

Improved battery life seems to be the biggest major driver for upgraders, Battery life leads at 53.2 percent, followed by new design/features (36.2 percent), display improvements (34.3 percent), cameras (28.1 percent), and AI/software (7.1 percent).

- Simple improved Battery life is the strongest single driver.

- A third wants new design and display improvements.

- Although it has a huge share of media buzz, AI sits far behind hardware features as a motivator.

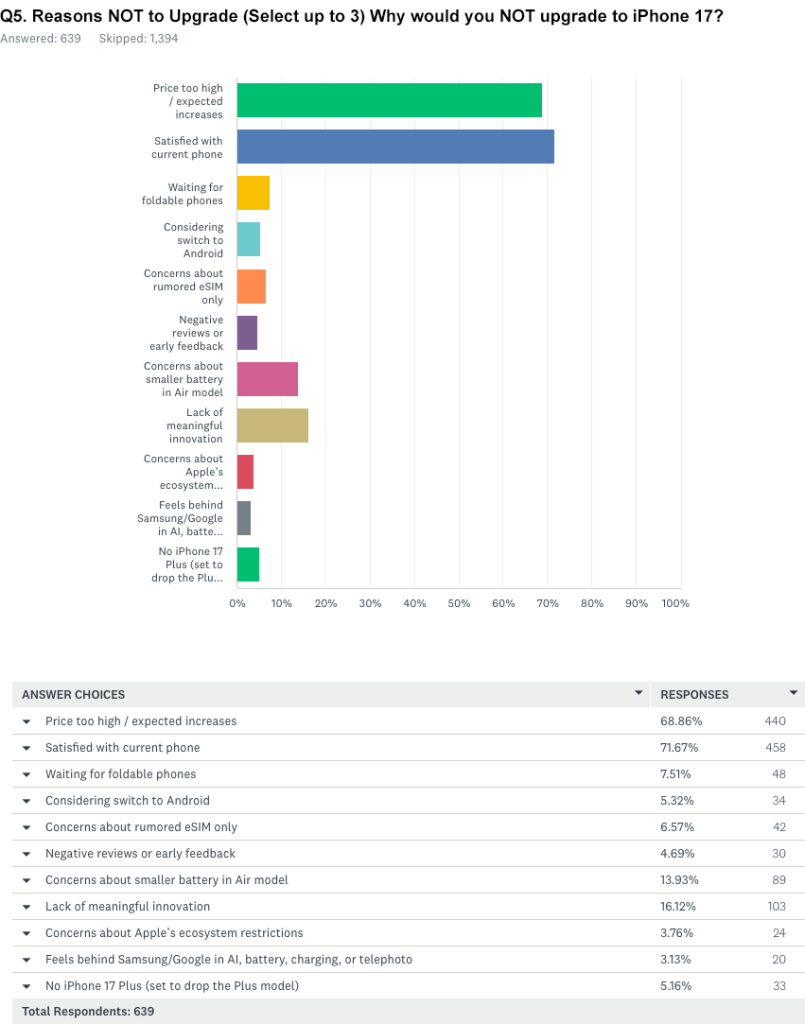

Q5. Why don’t people upgrade?

As remains consistent throughout the survey, price could be a big stumbling block for iPhone users if over stretched. Price is the top barrier at 68.9 percent. Satisfaction with current devices is also high at 71.7 percent. Others are waiting for foldables (7.5 percent), worried about eSIM (6.6 percent), or considering Android (5.3 percent).

- High satisfaction stretches upgrade cycles.

- Price is the consistent brake on intent.

- Foldables and eSIM concerns play smaller but persistent roles.

- People do not care that the iPhone Plus model is being dropped is a notable point here too!

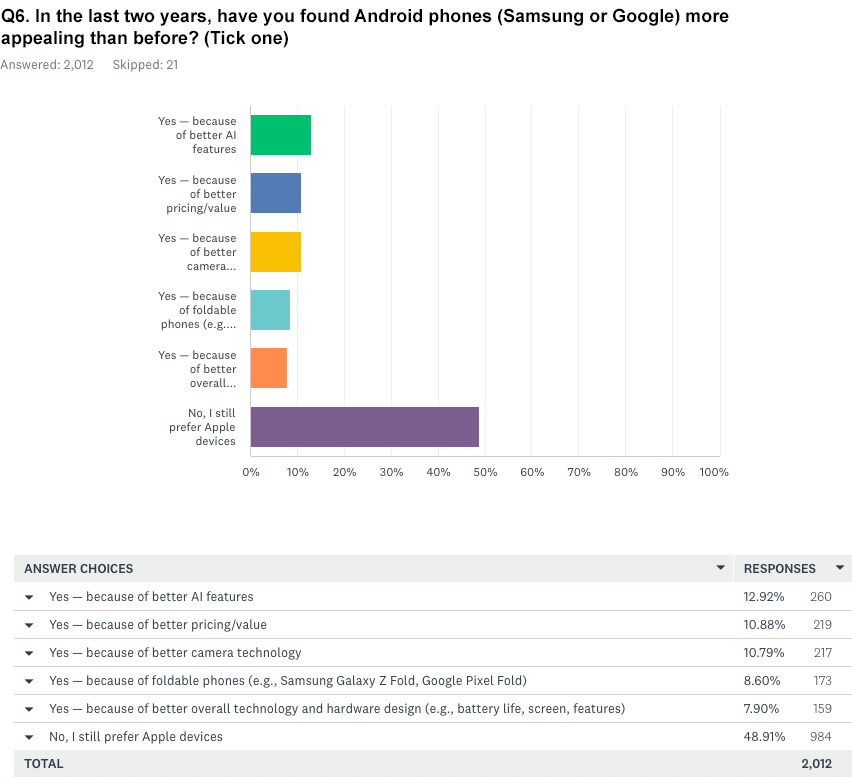

Q6. Android appeal

Almost half of iPhone users (49 percent) say nothing about Android appeals to them — yet the majority worryingly admit Android is becoming more attractive, citing AI (13 percent), pricing (11 percent), cameras (11 percent), and foldables (9 percent).

- Apple’s ecosystem keeps nearly half locked in.

- BUT Android’s edge shows up in AI, price, and foldables.

- Cameras remain another comparative strength offered by other brands.

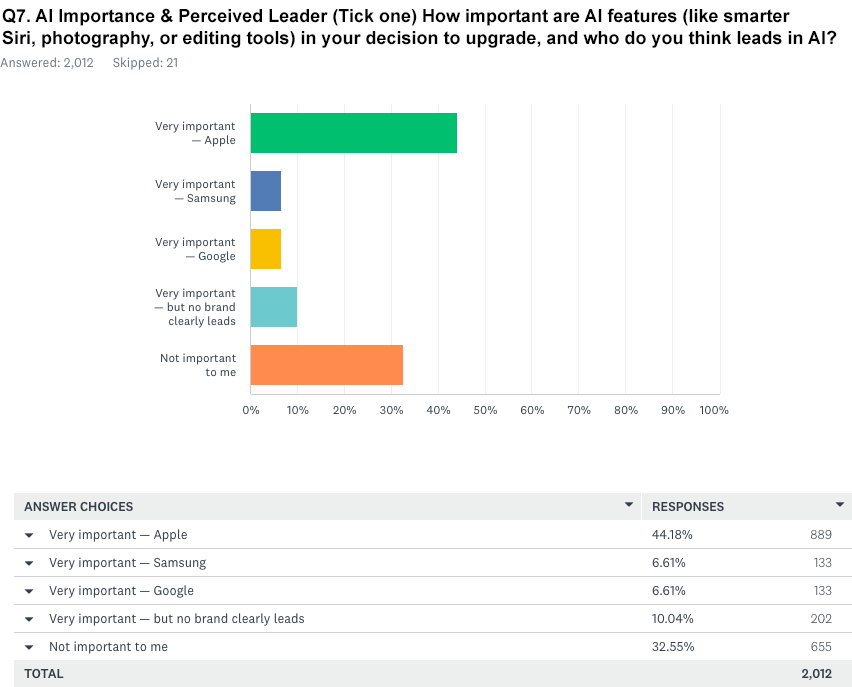

Q7. The role of AI (and who leads)

When asked just about AI, rather than its comparative, relative importance overall. 44 percent say Apple AI is very important, while 33 percent say it doesn’t matter. On leadership: Apple (44 percent), Samsung (6.6 percent), Google (6.6 percent), and 10 percent say no brand leads.

- AI matters to almost half of users but is not universal.

- iPhone owners perceive Apple as the AI leader.

- Rivals’ AI marketing hasn’t yet shifted perceptions.

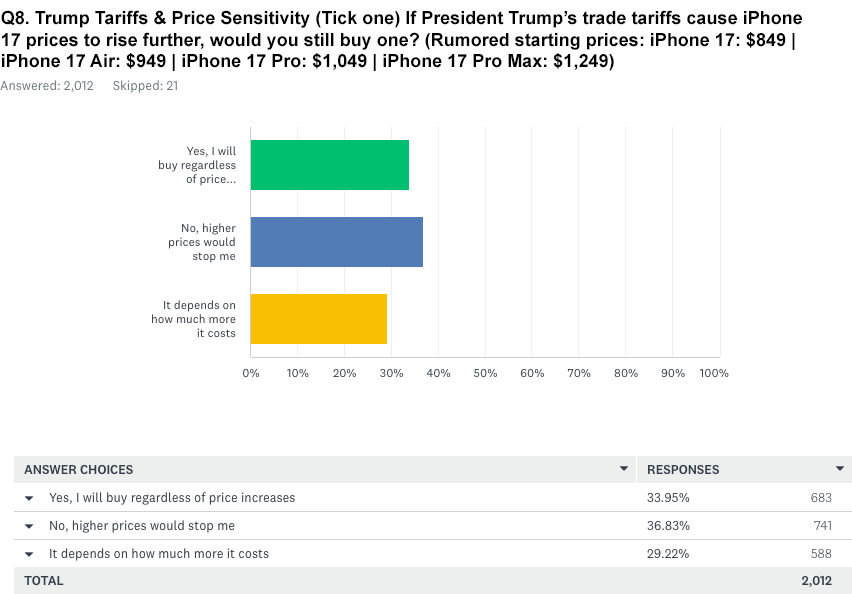

Q8. Tariffs and pricing pressure

If tariffs push prices up, 34 percent would still buy, 37 percent would hold off, and 29 percent say it depends. Reuters has reported tariffs could add as much as 43 percent to iPhone prices if exemptions change.

- Two in three buyers could hesitate if prices rise.

- A third are price-insensitive, but most will pause if costs jump.

- Financing and trade-ins may be critical in managing upgrade intent.

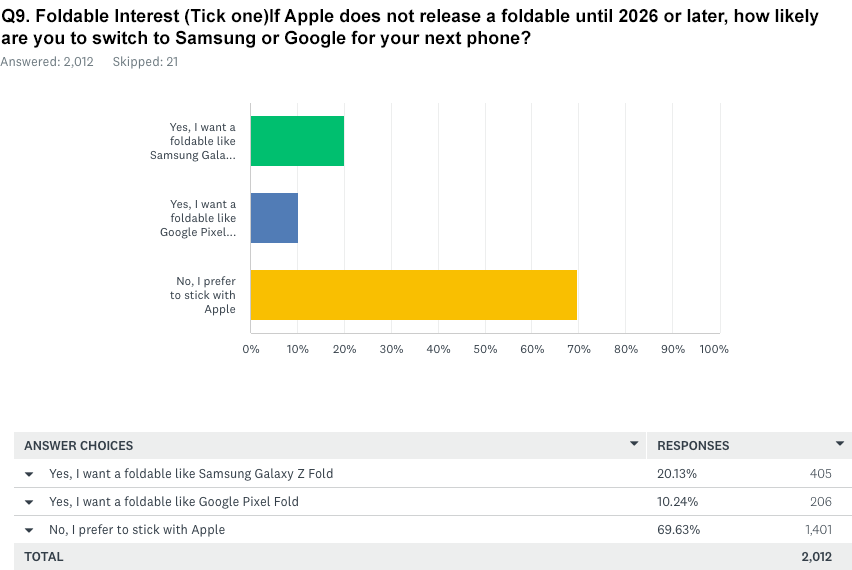

Q9. Foldables versus Apple loyalty

69.6 percent will stay with Apple, but 20.1 percent would consider Samsung foldables and 10.2 percent Google if Apple delays its own until 2026. Apple propensity to innovate seems like something that could affect loyalty. TechRadar has suggested Apple’s foldable might not arrive until 2026 or 2027.

- Loyalty is strong but not absolute.

- Samsung is best placed to win defectors, with its Foldable range.

- Apple’s timeline gives rivals a window.

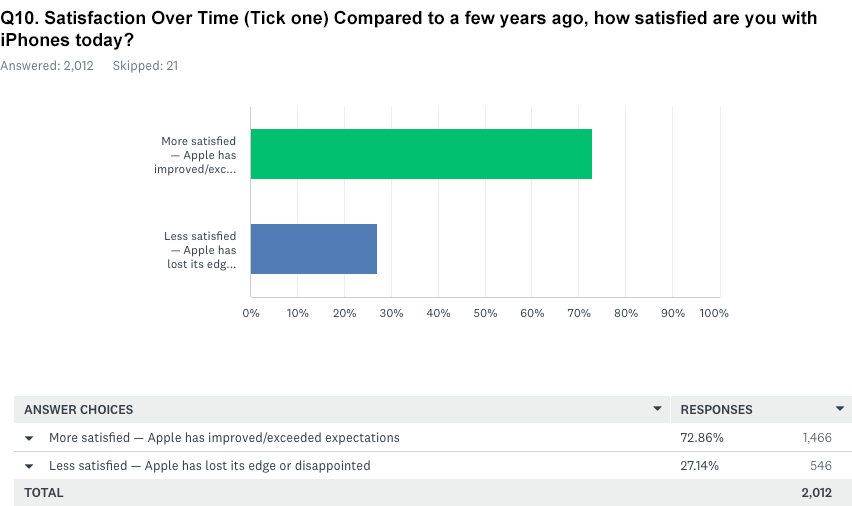

Q10. Satisfaction levels

73 percent say they’re more satisfied with iPhones today than in past years; a BIG 27 percent say less satisfied. So in essence over a quarter of existing iPhone owners are not as satisfied with iPhones than they were a few years ago. Reading between the lines this could be innovation sickness.

- High satisfaction underpins loyalty and intent.

- It also explains why cost is the key barrier, not dissatisfaction.

Summary

SellCell’s iPhone 17 pre-launch survey suggests Apple goes into Awe Dropping with momentum. Nearly seven in ten plan to upgrade, Pro and Pro Max lead, and the Air has sparked interest. Battery life is the top driver; price is the main brake.

Tariffs and foldables are the two external factors to watch. With 20 percent of iPhone owners saying they’d consider Samsung if Apple delays foldables until 2026, and with tariffs threatening to push prices higher, Apple faces a tricky balance. Still, strong loyalty and demand for Pro models suggest another headline September launch is likely.

Methodology

SellCell surveyed more than 2,000 U.S. adults who currently own an iPhone using a leading international survey platform in August 2025. There are no identifiable, personal details stored as part of this survey

Time To Trade-In?

With the clock ticking down to the awe-dropping event, there’s never been a better time to get the best value for your old iPhone if you’re thinking about upgrading to the iPhone 17. With only a few days left, now is the time to sell your iPhone and lock in the best price—guaranteed for up to 30 days ahead of the iPhone launch and release.

Our content is created in good faith and reviewed regularly - if you spot an error, please contact corrections@sellcell.com. Read our Editorial Policy