Other iPhone 17 models are holding value well, outperforming the iPhone 16 range at the 10-week mark.

Key Highlights

- The iPhone Air is the weakest-performing iPhone range in several years, losing up to 47.7% of its value within ten weeks.

- The main iPhone 17 lineup performs better, retaining around 9.7% more value than the Air.

- The iPhone 15 series still leads overall ten-week resale performance, with an average depreciation of 31.9%.

Introduction

Recent reports suggest that the core iPhone 17 models have enjoyed strong early demand, with sales momentum outpacing last year’s launch according to sources such as MacRumors. In contrast, the iPhone Air appears to have struggled from the outset, with coverage from outlets like IBTimes pointing to softer sales and lower production expectations.

This report will investigate whether the resale value of the iPhone 17 and iPhone Air is following the same pattern. Using ten weeks of SellCell data, it examines how the iPhone 17 lineup is performing compared with the iPhone 16, 15, and 14 ranges at the same ten-week point post-launch, and how the Air’s trajectory compares with its predecessors.

Main Findings

- The iPhone 17 range averages 34.6% depreciation after ten weeks, outperforming both the iPhone 16 (39.0%) and iPhone 14 (36.6%) ranges.

- The iPhone Air averages 44.3% depreciation, with losses ranging from 40.3% to 47.7%.

- The main iPhone 17 models retain 9.7% more value than the Air.

- Compared with previous generations, the Air performs 12.4% worse than the iPhone 15, 7.7% worse than the iPhone 14, and 5.3% worse than the iPhone 16.

- The best performing iPhone 17 model is the Pro Max 256GB at 26.1% depreciation.

- The worst performing device overall is the iPhone Air 1TB at 47.7% depreciation.

- The iPhone 15 lineup continues to lead ten-week resale performance at 31.9% average depreciation.

- The widening gap between the iPhone Air and the rest of the lineup suggests market concerns around the Air’s long-term desirability.

Chart Analysis

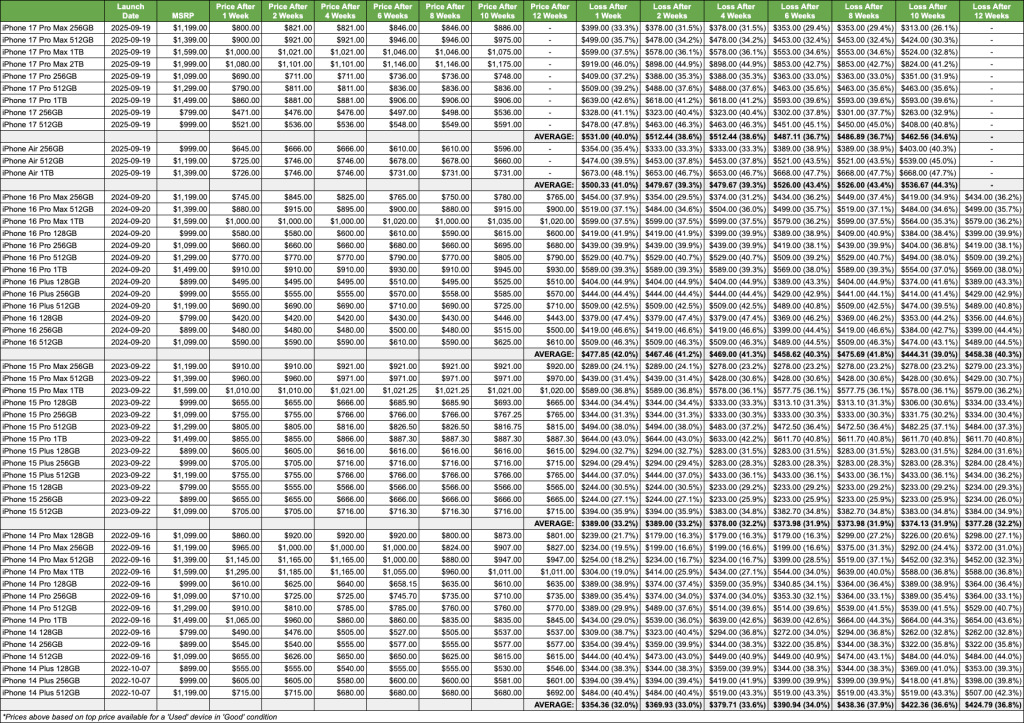

Full Depreciation Breakdown: iPhone 17 vs 16, 15, and 14 (10 Weeks)

- The iPhone 17 lineup has the widest spread between best and worst models, driven by strong Pro values and weak Air values.

- The iPhone Air 1TB’s 47.7% depreciation is the steepest ten-week drop of any iPhone since 2022.

- All iPhone 17 Pro and Pro Max models stay below 40% depreciation, reinforcing strong resale demand.

- While iPhone 17 depreciation stabilises by week 10, the Air continues to fall, signalling likely long-term issues with resale confidence.

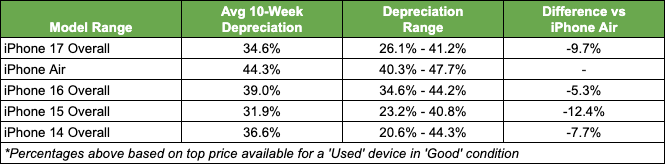

Average Depreciation by Model Range (10 Weeks)

- The iPhone 17 Series averages 34.6% depreciation, beating the iPhone 16 (39.0%) and iPhone 14 (36.6%).

- The iPhone Air averages 44.3% depreciation, making it the weakest performer across all recent generations.

- The iPhone 15 Series remains the best at ten weeks with 31.9% average depreciation, still ahead of the 17 range.

- The iPhone 17 Series holds around 10% more value than the iPhone Air after ten weeks.

- The iPhone Air performs 5–12% worse than previous generations (14, 15, and 16).

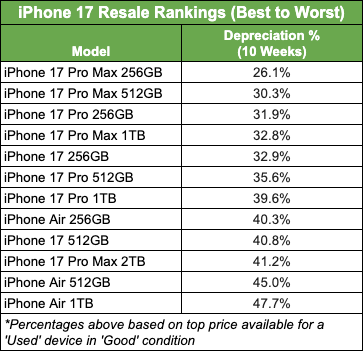

Best vs Worst Model Performance

- The iPhone 17 Pro Max 256GB is the best performer at 26.1% depreciation after ten weeks.

- The iPhone 17 Pro Max 512GB follows at 30.3%, keeping Pro Max models at the top.

- Standard iPhone 17 models fall between 32.9% and 40.8%, showing stable mid-range performance.

- All iPhone Air models sit at the bottom, between 40.3% and 47.7% depreciation.

- The iPhone Air 1TB is the worst performer overall at 47.7% depreciation.

Conclusion

Ten weeks of data makes one thing clear: the iPhone 17 range is performing as expected in the resale market, while the iPhone Air is not. The Air remains an unknown quantity to buyers and vendors alike. Slower sales, uncertainty around long‑term durability, and questions within the repair and refurbishment markets about parts, repair costs, and the ultra‑thin design all appear to be weighing on its resale value.

With depreciation already reaching as high as 47.7%, the Air is tracking far below every recent iPhone model. If this trend continues, owners may find themselves holding a very expensive—but undeniably beautiful—paperweight.

Methodology

SellCell analysed ten-week depreciation using real-time trade-in prices from more than 40 US-based buyback companies. All devices were assessed in good condition to ensure consistent comparisons. Depreciation figures were calculated by comparing original MSRPs with average trade-in prices at weeks 1, 2, 4, 6, 8, and 10. Averages include all storage capacities within each model range.

Our content is created in good faith and reviewed regularly - if you spot an error, please contact corrections@sellcell.com. Read our Editorial Policy